Table of Contents

When it comes to how to choose a secure digital wallet, what comes to mind is securing your finances electronically. The idea of securing your digital wallet is relevant due to the spate of cyber security threats.

Let’s dive into the concept of choosing a digital wallet that is secure.

Understanding Digital Wallets

What is a digital wallet?

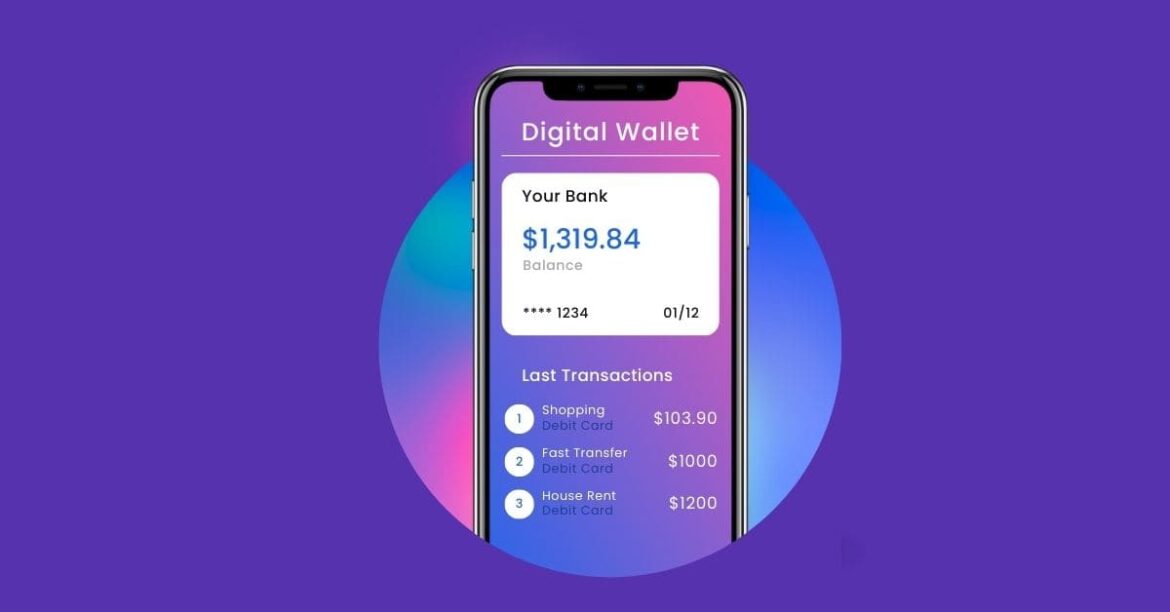

Digital wallets are virtual wallets where users store digital currencies or payment methods to complete transactions. Digital payments have become increasingly popular, so digital wallets are more commonly used now. They give users easy access to money, without needing cash or cards.

Digital wallets should have great features. They should be secure, with high-level security protocols. Plus, they should have tracking abilities so users can monitor their spending.

Assume you have a problem with your bank account and needed money but couldn’t get it from the bank. Once you discovered digital wallets you’re be amazed by their speed and convenience. After you start using them, you’ll prefer digital wallets for all kinds of transactions, for they are fast and reliable.

Types of digital wallets

Digital wallets come in different types. These are secure, convenient, and easy to use compared to physical wallets.

Types of digital wallets include:

- Hardware – a physical device that stores digital cash and secures private keys through encryption.

- Mobile – stores billing addresses and payment elements accessed through an app on a smartphone or tablet.

- Cloud-based – such as Google Wallet, with online databases for multiple cards.

Mobile digital wallets have become popular due to contactless payments and compatibility with numerous retail shops. Hardware wallets are highly secure since they use fingerprint authentication.

If you lose your physical wallet, and you’ve signed up for a mobile wallet service, it’ll allow you to freeze your account and protect your money until a time you could retrieve your physical wallet.

Benefits of using digital wallets

Digital wallets offer more than just convenience. They provide secure transactions, fast payment options, and quicker checkout times. Plus, you don’t need cash or credit cards – you just get instant access to funds. Here are some of the unique benefits:

- Convenience: Easy to use and quick payment options. No bulky wallet or long lines.

- Secure Payments: Financial info is safe and encrypted, so fraudsters can’t access it.

- Faster Checkouts: Transactions are done in a single click, instead of entering card details.

- Accessibility: Funds are available 24/7 from anywhere in the world.

- Rewards and Discounts: Loyalty rewards and discounts for frequent users.

- Organization: All payment info is in one place, making tracking expenses simpler.

Digital wallets can link multiple bank accounts and credit cards. Some also keep transaction histories confidential.

To optimize the experience, be vigilant against fraud, link multiple payment options, and stay informed about new offers and discounts.

Factors to Consider When Choosing a Digital Wallet

To choose a secure digital wallet with the right features and support, you need to consider many factors. When selecting your digital wallet, focus on the security features, supported cryptocurrencies, compatibility with your mobile device, user interface, and user experience, and the reputation and trustworthiness of the provider.

These sub-sections will help you make an informed decision to keep your digital assets secure.

Security Features

Security should be #1 when selecting a digital wallet. Make sure your funds are protected from fraud or hacking. A few key features to consider:

- Two-factor authentication: An extra layer of protection – like a code sent to your phone.

- Encryption: Strong encryption to keep data private.

- Multi-sig transactions: Multiple signatures are needed to complete a transaction.

- Cold storage: Keeps majority of funds offline, harder for hackers to access.

Also, check the provider’s track record and read reviews. Plus, keep login details safe and never share them. Prioritize security so your digital assets stay safe.

Encryption

Encryption is needed for a secure digital wallet. It keeps your financial information safe from hackers.

Look at the table:

| Digital Wallet | Encryption Type |

|---|---|

| PayPal | 256-bit |

| Apple Pay | AES-256 |

| Google Pay | RSA |

PayPal’s 256-bit encryption makes it hard for hackers to get your info. Extra security is also needed, like two-factor authentication and complex passwords.

Identity theft and online frauds are on the rise. Choose a wallet with top-notch encryption technology. Don’t settle for anything less.

Two-factor authentication: because ‘password123’ isn’t enough to keep your crypto safe from your cat!

Two-factor authentication

Using two-factor authentication is a must when choosing a digital wallet. Here are four reasons:

- An extra layer of security is provided by requiring users to give more than just a password.

- A fingerprint, face recognition, or an SMS code could be the second form of ID.

- This makes it much harder for hackers to get into your account.

- Even if someone knows your password, they still need another form of ID.

It’s important to know how many types or levels of two-factor authentication a wallet offers. Did you know that two-factor authentication was first used in World War I?

The British army used clay tablets with unique imprints to verify orders from headquarters. Digital wallets now use various methods of two-factor authentication, making them the most secure ever.

PIN protection

Choosing a digital wallet? Don’t forget ‘.3 PIN protection’! Follow this 4-Step Guide:

- Pick a strong, unique PIN. Not your birthdate or ‘1234’.

- Never share your PIN with anyone. No storing it on your device or writing it down.

- Enable auto-lock. This locks your device after a certain time, keeping your info safe.

- Keep changing your PIN. If someone guesses it, they can’t get into your wallet.

Plus, some wallets have extra security features like biometric authentication or two-factor auth.

Pro Tip: Log out from your wallet after every session for maximum safety.

Biometric authentication

Biometric authentication is essential for choosing a digital wallet. It provides an extra layer of security and helps stop unauthorized access.

Look at the table below for different biometric authentication methods in digital wallets:

| Digital Wallets | Biometric Authentication Methods |

|---|---|

| Apple Pay | Face ID, Touch ID |

| Samsung Pay | Fingerprint, Iris scanner |

| Google Pay | Fingerprint, Face ID |

It is important to note that biometric authentication can still be attacked. So, it’s wise to use strong passwords or PINs with biometric authentication.

When using a digital wallet with biometric authentication

- Keep the device’s software up-to-date.

- Don’t share your biometric data with others.

- Get added security and convenience with digital wallets having biometric authentication features.

Supported Cryptocurrencies

Digital wallets are now more popular than ever due to their convenience for sending and receiving crypto. One essential factor to consider is the supported coins.

See the table below for a list of popular wallets and their compatible cryptos. Not all wallets support every currency, so you must make sure yours is included.

| Digital Wallet | Supported Cryptocurrencies |

|---|---|

| Coinbase | Bitcoin, Ethereum, Litecoin, Bitcoin Cash |

| Exodus | Bitcoin, Ethereum, Litecoin, Dogecoin |

| Ledger Nano X | Bitcoin, Ethereum, Ripple (XRP), Litecoin |

| Trezor | Bitcoin, Ethereum, Litecoin |

| Blockchain.info | Bitcoin |

It is also important to look at security features and user interface. Two-factor authentication or integration with hardware wallets can offer extra protection.

Don’t miss out on the advantages of a digital wallet. Research and compare before making a decision – it could affect your crypto transactions going forward.

Compatibility with Your Mobile Device

When selecting a digital wallet, you need to consider if it’s compatible with your mobile device. Check the OS version and device model. Or else, you could face errors or glitches.

Opt for a wallet that’s user-friendly and simple to navigate. It should integrate seamlessly and have minimal disruptions when moving between platforms or managing funds. Good customer support on the app store will help address any technical issues.

Pro Tip: Research its security features, such as two-factor authentication and encryption. These provide extra protection from fraudsters or cyber-thieves.

User Interface and User Experience

When selecting a digital wallet, the look and feel of the user interface are key. A well-designed wallet should be easy to use with clear information.

The user experience should also be smooth, from setting up the account to loading funds and transacting. It’s important to consider the security measures of different wallets. Some require multiple layers of authentication, while others only need a password.

I once made the mistake of picking a digital wallet without properly assessing the user interface and user experience. Instead of feeling secure, I was overwhelmed by the steps required. Don’t choose a digital wallet quickly, without considering all factors.

Reputation and Trustworthiness of the Provider

Having trust and a good reputation is key when deciding on a digital wallet provider. Do your research to make sure they have no history of fraud or data breaches. To evaluate their reliability, look at their experience in the industry, customer reviews, and security measures.

Here’s a table with factors to consider when evaluating a digital wallet provider:

| Factors | Description |

|---|---|

| Years in | Has the provider been around a while? Long-serving providers are more likely to be reliable than new ones. |

| Business | What is their business model? Make sure it fits with your long-term goals and doesn’t have any hidden fees. |

| Customer reviews | Online customer reviews can tell you a lot about a provider’s track record. Watch out for any red flags. |

| Security measures | Does the digital wallet have good privacy policies? Is two-factor authentication or biometric verification available? These measures can help protect your data. |

When choosing a digital wallet, also consider compliance with government regulations and flexibility for policyholders.

Popular Digital Wallets and Their Features

To explore popular digital wallets and their features in order to help you choose a secure digital wallet, we have selected three top digital wallets:

- Coinbase Wallet,

- MyEtherWallet, and

- Bread Wallet.

Each of these wallets has unique features that make them a top choice among users. Let’s dive into these sub-sections to understand their key features.

Coinbase Wallet

Digital wallets are key for storing, managing, and using cryptocurrencies. One of the most famous ones is Coinbase Wallet which offers a safe and simple platform to use various cryptocurrencies.

It has amazing features like a user-friendly interface, secure storage, and support for multiple cryptocurrencies like Bitcoin, Ethereum, and Litecoin. Moreover, Coinbase Wallet also has integration with dApps like Uniswap and Compound Finance which allow users to easily lend or borrow their cryptocurrencies.

If you want an effective wallet to manage your crypto portfolio, Coinbase Wallet is a great choice – don’t miss out!

Digital wallets with poor security are like playing Russian roulette – the bullet is your financial info.

Security Features

Digital wallets are becoming increasingly popular due to convenience. Before adopting one, customers consider the security features. It’s vital to understand these features for protecting personal info and transactions.

- Passcode/Touch ID/Face ID: Authentication measures secure access to accounts. Only authorized users can access and complete transactions.

- Encryption: Complex algorithms convert sensitive data into an unreadable format. If someone intercepts, they can’t decipher it.

- Tokenization: Tokenization replaces sensitive info like card numbers with tokens. Protects data from hackers.

- Biometric Authentication: Biometrics provides extra security. Even if a device is stolen, nobody can access it without finger or face recognition.

- Fraud detection mechanism: AI-based fraud detection monitors user activities and flags any unusual ones. Reduces potential for fraud.

Note that while all wallets have security features, their implementation varies. Read up on a wallet’s features before committing. Use multi-factor authentication like Face ID or fingerprint sensor.

Take regular backups and update the wallet system with the latest security patches. Stay informed and exercise caution when storing sensitive data.

Supported Cryptocurrencies

Digital wallets are modern payment solutions – and they come with support for various cryptocurrencies! These currencies are virtual or digital tokens that enable easy transactions. Let’s take a look at which digital wallets support which cryptocurrencies in the table below:

| Digital Wallet | Supported Cryptocurrencies |

|---|---|

| Coinbase | Bitcoin, Ethereum, Litecoin, Bitcoin Cash |

| Binance | Bitcoin, Ethereum, Litecoin, Bitcoin Cash, Ripple |

| Trezor | Bitcoin, Ethereum, Litecoin, Bitcoin Cash |

| Ledger Live | Bitcoin, Ethereum, Litecoin |

| Mycelium | Bitcoin |

Some wallets offer support for multiple cryptocurrencies, and some just one. Now, when it comes to selecting the right cryptocurrency for your digital wallet, there are certain features to consider – like transaction times and fees.

So, let’s all make use of this modern payment solution! Pick the wallet that meets your needs, and start taking advantage of the convenience offered by these virtual currencies! And if Apple and Android can get along, why can’t digital wallets?

Compatibility

For smooth transactions, digital wallets must be compatible with diversified systems and devices. An ideal digital wallet should be able to work with various platforms and devices, making it user-friendly. The following table shows which popular digital wallets can be integrated with different devices and operating systems:

| Digital Wallet | Android | iOS | Windows |

|---|---|---|---|

| Google Pay | Yes | Yes | No |

| Apple Pay | No | Yes | No |

| Samsung Pay | Yes | No | No |

Google Pay is exceptional as it provides cross-platform compatibility, functioning effortlessly on both Android and iOS. On the contrary, Apple Pay is only limited to iOS devices. Also, Samsung Pay is restricted to a few Samsung devices running on chosen operating systems.

It is noteworthy that though most digital wallets have limits with regard to compatibility with certain operating systems or devices, there are often options to integrate third-party apps or services to extend their compatibility range.

Pro Tip – Prior to selecting a digital wallet, take into account its compatibility with your device or system requirements to avoid any trouble during transactions.

Exploring these digital wallets is like an interactive book, however, every route leads to the same outcome: a more satisfied wallet.

User Interface and Experience

Digital wallets are recognized for their assorted features, comprising of user interface and experience. The design of a digital wallet’s user interface can affect the users’ overall experience.

The table hereunder reveals renowned digital wallets and their user interface and experience features:

| Digital Wallet | User Interface | Experience |

|---|---|---|

| PayPal | Uncomplicated design with easy navigation | Good customer service |

| Google Wallet | Visually pleasing design with smooth flow | Reward plan |

| Samsung Pay | Clean design with minimalistic approach | Compatible with most devices |

| Apple Pay | Intuitive design for effortless payments | Safe transactions |

Plus, some digital wallets provide unique features that make them one-of-a-kind from their rivals. For example, PayPal allows linking multiple bank accounts while Samsung Pay supplies access to exclusive deals and reductions.

To better the user interface and experience, it is suggested that digital wallets supply clear guidelines, implement responsive design principles, and provide personalized features dependent on each user’s likes. Offering prompt customer service can also help deal with any issues that may come up.

Altogether, the success of a digital wallet relies on its capacity to deliver a seamless user experience via well-crafted user interfaces and imaginative features. With these digital wallets, you can finally feel like an accepted grown-up without needing to carry physical cash.

Reputation

Digital wallets are must-haves in the finance world today. It’s vital to check their reputation when selecting one. Make sure it is trustworthy.

Safety and security for your funds should be a priority. So, consider providers like PayPal or Venmo that have a great reputation. Read reviews and user feedback, too.

Choose a wallet with cool features or a big network. For example, Google Pay has a neat interface. Square Cash has a vast merchant base.

Statista reported that PayPal has over 377 million active users worldwide, making it a leading digital wallet. MyEtherWallet is another option. It keeps your digital currency safe from hackers… unless you forget your password.

MyEtherWallet

MyEtherWallet has essential features like security, access, integration, and support.

Security features include hardware wallet support, two-factor authentication, and multi-sig functionality.

You can access it from desktop and mobile devices without any installation. Plus, it is compatible with other Ethereum-based applications. FAQs, forums, and video tutorials are available for support. This wallet even offers a token creation service.

One user had a great experience with MyEtherWallet. He lost his password but was able to restore access quickly with the help of its support system. MyEtherWallet is a secure and accessible gateway to the world of cryptocurrency. Digital pickpockets won’t be able to get their hands on your money!

Security Features

Security is a top concern when using digital wallets. Popular digital wallets provide features like:

- Two-factor authentication

- End-to-end encryption

- Biometric authentication like fingerprint and facial recognition

- Passcode protection

- Real-time activity alerts and notifications

Features vary from wallet to wallet. Some have extra protection, such as location-based restrictions or auto-lock timers. Some even offer insurance against fraudulent activities.

A user shared a story about the importance of digital wallet security. They lost their phone with sensitive wallet info and personal details. However, thanks to the security measures on that platform, no unauthorized transactions happened. This reinforced their trust and they still use it.

Before you get started, better check the supported cryptocurrencies for these digital wallets.

Supported Cryptocurrencies

Digital wallets are gaining popularity due to their convenience and security features. It’s important to know what cryptocurrencies each wallet supports. Doing this will help decide if the digital wallet is suitable for your cryptocurrency needs.

Below is a table of the cryptocurrencies supported by some of the most popular digital wallets:

| Digital Wallet | Supported Cryptocurrencies |

|---|---|

| Coinbase | Bitcoin, Bitcoin Cash, Ethereum, Litecoin, USD Coin |

| Binance | Bitcoin, Ethereum, Binance Coin, Ripple, Tether |

| MyEtherWallet | Ethereum and all ERC-20 tokens |

| Ledger | Bitcoin, Ethereum, Bitcoin Cash, Litecoin |

MyEtherWallet is special since it supports all ERC-20 tokens. Coinbase’s selection is limited compared to other wallets. But, it has a user-friendly interface and high-security standards.

Pro Tip: Look at features like transaction fees and convenience in accessing funds, in addition to supported cryptocurrencies, when choosing a digital wallet. Digital wallets: the only thing that’s truly compatible with both your phone and your wallet.

Compatibility

Compatibility is key when selecting a digital wallet. It shows if the wallet works with different devices, OSs, and bank accounts. To make it simpler for you to compare wallets, let’s have a look at their compatibility.

| Wallet | Devices | OS | Bank Accounts |

|---|---|---|---|

| PayPal | Mobile | iOS, Android | US banks |

| Venmo | Mobile | iOS, Android | US banks |

| Google Pay | Mobile | Android | Major cards and banks |

PayPal and Venmo are compatible with mobile devices, iOS & Android, and just US banks. Google Pay supports only Android but can be used by people from different countries and all major cards.

Also, PayPal has a Cash Card feature that allows people to access their funds immediately; this works with all compatible OSs and devices.

Pick a digital wallet that fits your device, OS, and bank account/card issuer for hassle-free payments. Don’t miss out on the perks of using a wallet that matches your needs – choose carefully to benefit from fast and safe payments anywhere. Even your grandma can master using these wallets in no time!

User Interface and Experience

Digital wallets have unique UIs and UXs that attract different users. PayPal focuses on ease and convenience, Venmo has a fun social vibe, and Cash App is modern and Bitcoin-friendly.

I recently used Cash App to pay my friend back for concert tickets. It was easy to navigate and I even got to personalize the payment card! Cash App’s design gave me confidence in my transaction – no wonder it has grown in popularity!

Digital wallets: Entrusting your money to electrons is sometimes safer than to humans.

Reputation

A digital wallet’s reputation is very important to users who want secure transactions. Most digital wallets are reliable, with top security features and simple navigation. User-friendly interfaces give a stress-free experience.

Digital wallets provide many payment options such as bank transfers, debit/credit cards, PayPal accounts, and more. These methods can be stored safely in the wallet. Some special features include strong encryption tech and fraud protection to protect sensitive data from theft.

One situation happened when someone’s phone got taken away in another country. With no money, they were happy to find their digital wallet account was secure and accessible from another device. Customer support was available 24/7 for quick help. The digital wallet’s support team blocked any illegal activities and recovered the lost funds quickly, showing that trusting the wallet’s reputation was the right choice.

Bread Wallet

What sets Bread Wallet apart? Simplicity! The app has a clean and effortless interface, so it’s super accessible to those new to cryptocurrencies. Plus, they use Touch ID or passcode for max security.

Transactions are almost instantaneous, and two-factor authentication is always recommended. All that with no need to wear an orange jumpsuit – digital wallets have better security than a maximum-security prison!

Security Features

Digital wallets are an increasingly popular way to pay – but what about security? Let’s look at how they keep our data safe:

- Two-factor authentication: Most wallets feature this.

- Encryption tech: Encrypts sensitive data for secure transactions.

- Secure PIN: Required to make payments from the wallet.

- Fingerprint/facial recognition: For biometric authentication.

- Identity verification checks: To prevent unauthorized access.

- Geo-fencing: Alerts if payments occur outside the user-specified range.

Apple Pay stores all transaction info in Secure Element, encrypted inside the device, and never sent to Apple servers or shared with merchants. Google Pay encrypts all info between your device and the terminal. Samsung Pay has Samsung KNOX for defense-grade mobile security.

For added safety, we recommend:

- Updating digital wallets regularly as updates improve data protection.

- Ignoring unknown links which could be phishing attacks.

- Avoiding public Wi-Fi when making payments as they could be compromised.

With these tips, we can keep our digital transactions secure! And be prepared to spend a fortune keeping up with the growing list of supported cryptocurrencies.

Supported Cryptocurrencies

With loads of cryptocurrencies, it’s essential to know which digital wallets can support them. Here’s a summary of the most popular wallets and the coins they support.

| Wallet Name | Supported Cryptos |

| Bitcoin Core | Bitcoin (BTC) |

| Mycelium | Bitcoin (BTC), Ethereum (ETH) |

| Trezor One | Bitcoin (BTC), Bitcoin Cash (BCH), Litecoin (LTC), Dash (DASH), Zcash (ZEC) |

| Coinbase Wallet | Bitcoin (BTC), Bitcoin Cash (BCH), Ethereum (ETH), Ethereum Classic (ETC), XRP, Stellar Lumens (XLM) |

It’s worth keeping in mind that some wallets have a larger crypto selection than others. For example, Mycelium only supports two coins, whereas Trezor One offers five. It’s essential to research what cryptocurrencies you need before you make your choice.

Don’t miss out on the benefits of a digital wallet by choosing one which doesn’t support your desired coin. Make sure to check what coins each wallet supports before investing!

Compatibility

Compatibility’ is key for digital wallets to integrate with other online services. For example, if you can’t use your preferred payment method in a store, compatibility makes sure you’re still good to go. It includes device type, OS, and network connections.

Look at Apple, Google, and Samsung Pay: they all have device and network compatibilities – iPhones and iPads, Androids and Samsungs, plus Wi-Fi and cellular.

Plus, some wallets offer more features and partnerships for interoperability. Like PayPal, where users can get extra card support for eBay, and rewards from certain merchants.

Before you pick a digital wallet, make sure it has the basic compatibility features you need. Otherwise, it’s like navigating a maze with no map or breadcrumbs!

User Interface and Experience

Digital wallets can either make or break customers’ willingness to use them. Success relies on their ease of use, safety, and intuitiveness. Here are some popular digital wallets and their features for interface design and user experiences.

| Wallet Name | UI Design | User Experience |

|---|---|---|

| PayPal | Minimalistic design with easy navigation | Simple to use, but hidden charges on large transactions |

| Google Pay | Material design with simple card-based navigation | Easy transaction management and user data protection through fingerprint authentication |

| Apple Pay | Clean interface built with iPhone technologies like Touch ID and Face ID | Fast transactions with successful security measures, no personal information stored by Apple servers |

| Samsung Pay | Sleek, streamlined interface with customizable swipe gestures | Convenient for both online buying and point-of-sale payments, users praise it |

Paypal has an uncomplicated design without any clutter. Google Pay’s interface is material designed with a few self-explanatory cards for smooth navigation. Apple Pay is critically acclaimed. It integrates seamlessly into iPhones and iPads while protecting user-data privacy. Samsung Pay features customizable swipe gestures for activating frequently-used functions.

Pro-tip: Choose a digital wallet that suits your needs. If you are an iOS user who values privacy, Apple Pay is perfect for you! Your reputation is important, but these digital wallets will keep your money safe and sound.

Reputation

Digital wallets are popular – and their reputation matters when picking one. Security, user experience, and customer support all play a role. Research and read reviews first to avoid problems later.

Some digital wallets can handle multiple currencies – perfect for frequent travelers. Plus, cashback and loyalty programs can sweeten the deal.

A friend had her phone stolen abroad. All her cards and cash were in a digital wallet app. She managed to recover access with security measures and informed banks right away. It shows how important it is to go with a secure digital wallet.

Time to step up your wallet game! Choose a digital one – but keep an eye on it.

Conclusion on How to Choose a Secure Digital Wallet

To conclude your journey towards choosing a secure digital wallet with confidence, we present a brief recap of important points followed by our final thoughts on the subject.

The recap will jog your memory on the key factors to consider when selecting a digital wallet. Then, we’ll offer our final thoughts on what it takes to make an informed decision that meets your unique needs.

Recap of Important Points

We’ve discussed some key points in this article. Like the importance of heading structure for accessibility and SEO. Plus, the types of headings and how to use them in HTML. Headings make it easier for people to understand content.

Fun fact: Headings have been used since ancient times! Scribes used decorations and larger font sizes to show new sections in texts. Now, we use modern headings online.

And remember: Selecting a digital wallet is like selecting a condom. Never be cheap or careless with protection.

Final Thoughts on Choosing a Secure Digital Wallet.

When picking a digital wallet, security is always a top priority. Followed by how easy it is to use and if it’s user-friendly. Plus, you want to select a wallet that supports the cryptocurrencies you want to hold.

Searching for the right one sounds overwhelming. But with enough research and examining your choices, you can find the perfect wallet.

Another factor to think about when choosing a digital wallet is multi-factor authentication. It adds another layer of security that helps protect your funds from theft or unwanted access. Some wallets even have extra features like auto fee adjustments to speed up transaction times.

Choose a digital wallet that is secure and simple to use. With so many great options available, now is the time to get into cryptocurrencies and invest securely. Don’t wait – start exploring your options today!